As a small business owner, one of the crucial responsibilities you face is ensuring accurate and timely compliance with various tax regulations. Among these, the W-2 form is a fundamental document that requires careful attention and precision. Issued annually to employees and submitted to the Internal Revenue Service (IRS), the W-2 form reports wages, tax withholdings, and other relevant financial information. To help you navigate this vital aspect of your business, here are five essential tips for handling W-2 forms with compliance and reporting excellence:

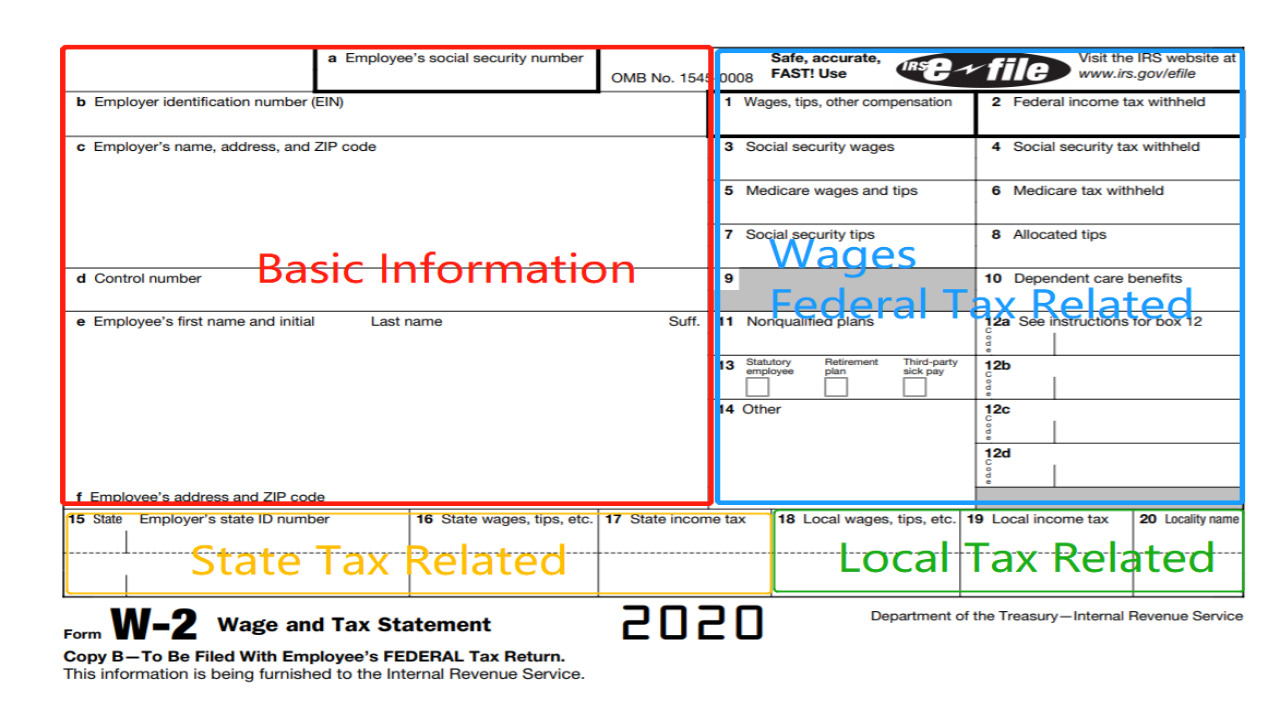

Understand W-2 Basics

Before diving into the complexities of W-2 reporting, it’s crucial to grasp the basics. The W-2 form is used to report wages and tax withholdings for each employee in your business. It includes details such as the employee’s Social Security number, total wages, federal and state income tax withholdings, Medicare and Social Security taxes, and any other deductions or benefits. Familiarize yourself with the IRS guidelines and ensure you have the correct version of the form for the relevant tax year. By the way, you can generate a W-2 online.

Accurate Employee Information

Accuracy is paramount when it comes to W-2 forms. Ensure that you have up-to-date and error-free information for each employee, including their full legal name, Social Security number, address, and any other relevant personal details. Mismatched or incorrect information may lead to processing delays and potential penalties. Implement a system to regularly verify and update employee records to avoid any discrepancies.

Classify Workers Correctly

Properly classifying workers as employees or independent contractors is crucial. Misclassifying workers can result in serious consequences, such as penalties for unpaid employment taxes. Employees are issued W-2 forms, while independent contractors receive 1099-NEC forms. Understand the IRS guidelines for worker classification to ensure compliance and avoid potential legal issues.

Timely Filing and Distribution

Meeting deadlines for W-2 form filing and distribution is of utmost importance. The deadline for employers to send W-2 forms to their employees is typically January 31st of each year, covering the previous calendar year. Additionally, businesses must file copies of the W-2 forms with the Social Security Administration (SSA) by the end of February. Failure to adhere to these deadlines can lead to penalties. Set reminders and establish a streamlined process to ensure timely compliance.

E-Filing for Efficiency

While paper filing is still an option, the IRS encourages electronic filing (e-filing) for W-2 forms due to its efficiency and accuracy. E-filing allows for faster processing and reduces the likelihood of errors. There are various IRS-approved online platforms and software that can facilitate the e-filing process. Make sure to choose a reputable and secure service to safeguard sensitive employee data.

Conclusion

Navigating the complexities of W-2 forms can be challenging for small business owners, but compliance with tax regulations is essential for the success and reputation of your business. By understanding the basics, ensuring accurate employee information, proper worker classification, timely filing, and embracing e-filing for efficiency, you can confidently handle W-2 forms and maintain compliance with IRS requirements.

Remember, W-2 forms not only impact your employees’ tax reporting but also reflect the financial integrity of your business. Seek professional advice if you’re uncertain about any aspect of W-2 reporting to avoid costly mistakes and penalties. Staying compliant will not only keep your business in good standing but also foster trust and confidence among your employees and stakeholders.